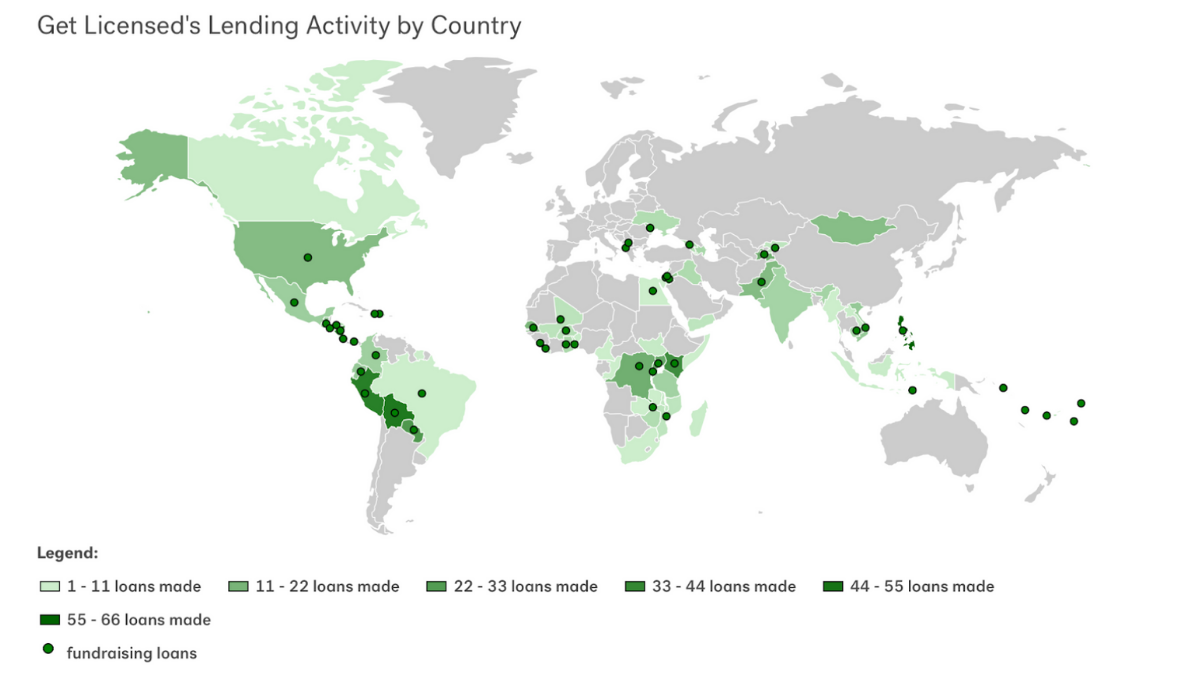

We are proud to announce that Get Licensed recently crossed the 1000 loan milestone, providing loans across over 70 countries. At Get Licensed, our motto is to do the right thing and have always adopted a strong moral compass and charitable ethos. We wouldn’t have been able to accomplish this without all the love and support from our customers.

When we arrange training for our security personnel, we believe we are doing the greater good by protecting communities while enriching individuals and guiding them on the way to a better future through training and improved career prospects.

But it doesn’t stop there. While our training courses centre on the UK security sector, our charitable goals have a more global outlook and reach.

That’s why we are honoured to partner with Kiva. Everyone knows the saying, “Give a man a fish, and you’ll feed him for a day. Teach a man to fish, and you’ve fed him for a lifetime.”

This concept is at the heart of the Kiva philosophy as it aims to tackle poverty in mainly underdeveloped countries. Most people are proud, regardless of their financial status. Handouts are not always the answer. That’s why Kiva offers loans rather than gifts. The recipients of these loans are usually far outside the realms of realistic finance. That is not to say that those receiving the loans have not thought long and hard about their business goals.

The loans are often very simple. A vast majority of the loans that Get Licensed help to fund along with Kiva are agricultural loans to farmers for crop seeds, essential equipment to help them harvest their crops, and wages for workers while the crops grow. Or they are basic loans for traders who have market stalls rather than shops and need loans to buy a larger amount of stock at better prices.

Kiva works by sending field partners into communities, and potential borrowers apply for loans. The loans, once considered and approved, then appear on the Kiva website. Funds for loans are achieved by crowdfunding of $25 increments or more. Once the loan amount is met, the borrower will receive their loan and begin to repay it in affordable instalments.

Unlike charity donations, if you choose to crowdfund and fund loans with Kiva, it’s a win-win!

Not only have you helped a person in an underdeveloped country battle poverty and often educate their children, you even get your money back! In addition to this, by choosing to fund loans in small increments, you can spread your loan’s liability without putting all your eggs in one basket should a lender be unable to make repayments. And in fact, the repayment percentage is extremely high at 97%, so your money is also very safe.

Not just that, unlike most charitable donations, it’s a very anonymous way of giving, in that you can choose to support a particular charity. But you never have any real idea as to the faceless person that you might have helped.

At Kiva, you can choose who you want to support and how. It’s truly a fantastic way to help. Once the borrower has repaid the loan, you can choose to do one of three things. Simply withdraw your money. Or you can donate.

Or you can rinse and repeat and go on to help fund more loans.

There’s another saying that we believe Kiva encompasses brilliantly:

In giving, we receive.

We are so proud to know that, in some small way, we have helped hardworking individuals in underdeveloped countries feed, support and educate their families. That’s why we intend to keep on going! And funding more loans for more people like Mary, a fruit and vegetable seller in Kenya, Josephine, a fish seller in the Philippines, and Paea, a handicrafts maker in Tonga.

Kiva envisions a financially inclusive world where all people hold the power to improve their lives. If you, like us, think that’s a brilliant dream, then get on board today by visiting Kiva. You can help from as little as $25!

Leave a Reply